Owning a home has great financial benefits. Because of this, more and more experts are growing concerned about the ramifications of a falling homeownership rate.

Owning a home has great financial benefits. Because of this, more and more experts are growing concerned about the ramifications of a falling homeownership rate.

The widespread myth that perfect credit and large down payments are necessary to buy a home are holding many potential home buyers on the sidelines.

Now that much of the dust has settled and the panic has waned, let’s take a look at what impact Britain’s exit from the European Union may have on the U.S. housing market. The most immediate impact of Brexit will be on mortgage interest rates.

View More

Some Highlights: The Cost of Waiting to Buy is defined as the additional funds it would take to buy a home if prices & interest rates were to increase over a period of time. Freddie Mac predicts interest rates to rise to 4.8% by next year.

View More

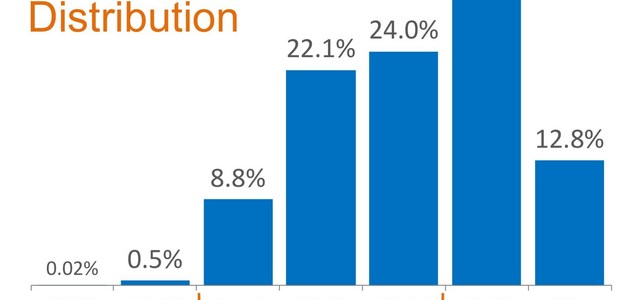

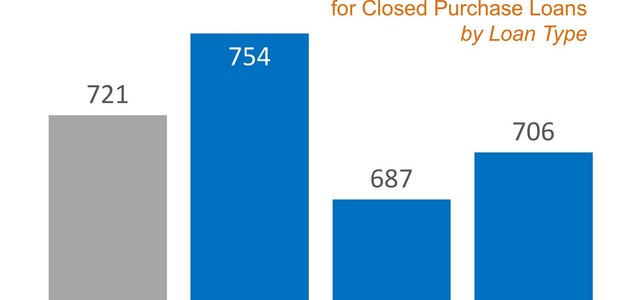

Fannie Mae recently released their “What do consumers know about the Mortgage Qualification Criteria?” Study. The study revealed that Americans are misinformed about what is required to qualify for a mortgage when purchasing a home.

Read the article on simplifyingthemarket.com >

View More

People often ask whether or not now is a good time to buy a home. No one ever asks when a good time to rent is. However, we want to make certain that everyone understands that today is NOT a good time to rent. The Census Bureau recently released their ...

View MoreIf you are debating purchasing a home right now, you are probably getting a lot of advice. Though your friends and family will have your best interest at heart, they may not be fully aware of your needs and what is currently happening in the real estate market.

View More

Today, many real estate conversations center on housing prices and where they may be headed. That is why we like the Home Price Expectation Survey. Every quarter, Pulsenomics surveys a nationwide panel of over one hundred economists, real estate experts and investment & market strategists abo

View More

In the latest Rent vs. Buy Report from Trulia, they explained that homeownership remains cheaper than renting with a traditional 30-year fixed rate mortgage throughout the 100 largest metro areas in the United States. The updated numbers actually show that the range is from an average of 16%

View More

There has been much written about how dramatically home values have increased over the last several years. With the increase in values, comes an increase in the equity each home owning family now has. The Joint Center of Housing Studies at Harvard University recently reported that, after taking infl

View More